MONEY MASTER PRO

Build Your Financial Future With Clarity and Confidence

You deserve a simple and proven plan that helps you grow wealth, reduce taxes and protect your family.

Money Master Pro gives you clear steps that create financial confidence for life.

A conversation with Linda can change how you feel about money forever.

MONEY MASTER PRO

Build Your Financial Future With Clarity and Confidence

You deserve a simple and proven plan that helps you grow wealth, reduce taxes and protect your family.

Money Master Pro gives you clear steps that create financial confidence for life.

A conversation with Linda can change how you feel about money forever.

The Real Problem Behind Money Stress

Most people work hard their entire lives yet never feel secure with their money.

They worry during tax season.

They feel uncertain about retirement.

They want to build wealth but are not sure where to start.

And they often feel embarrassed to ask for help.

The truth is simple

Money is not confusing

You just have never had someone explain it clearly and personally

Money Master Pro exists for one reason. To give you clarity so you can move forward with confidence.

Our Commitment to Your Legacy

Your Legacy Matters

At Money Master Pro™, everything we do is guided by one purpose: to help you build a substantial, lasting legacy that protects your family and strengthens your financial future.

What We Stand For

• Client-first service

• Education and clarity

• Long-term wealth preservation

• Integrity and transparency

• Strategic legacy planning

• Excellence in every interaction

How We Support Your Journey

• Helping you make confident, educated decisions

• Providing clear and actionable next steps

• Ensuring your plan evolves as your life changes

• Keeping your legacy goals at the center of every strategy

Our Long-Term Partnership Promise

We commit to walking beside you through every season of life. Your legacy, wealth, and future matter to us — today and decades from now.

Your Support Contact

Money Master Pro™ Support

Email: [email protected]

The Money Master Pro Advantage

Money Master Pro is not a generic financial service. It is a personalized strategy designed by a trusted CPA who understands real people and real life.

Clarity

Everything is explained in simple language so you always understand your next step.

Confidence

You receive strategies that are proven, practical and tailored to your life.

Control

You learn how money works so you can make decisions without fear or confusion.

Consistency

You get a plan that grows with you, your family and your goals.

This is financial guidance built for busy families and professionals who want long-term stability with less stress.

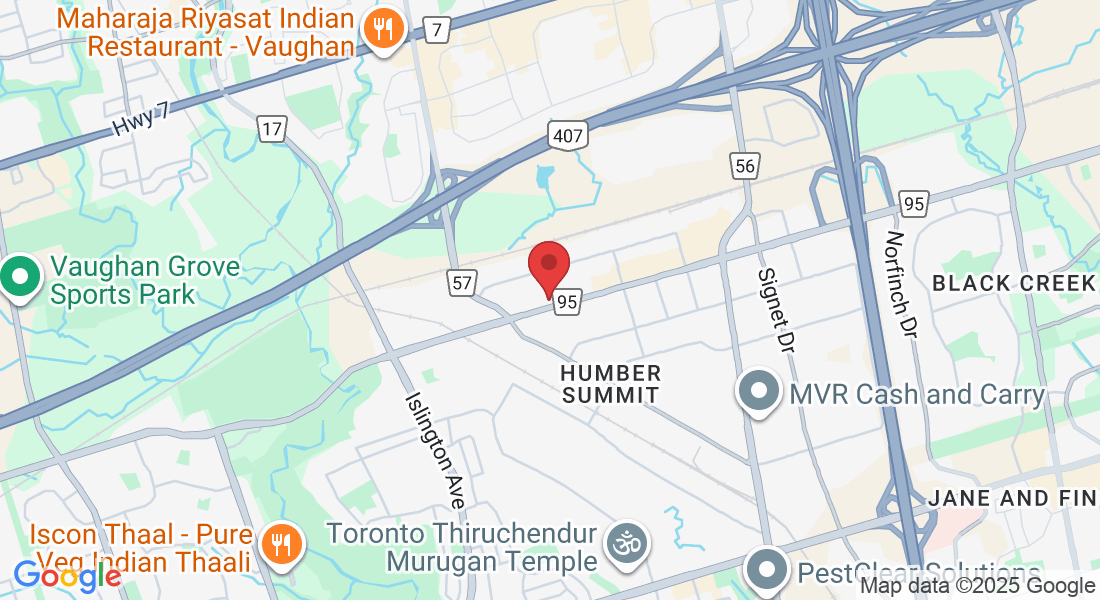

No Obligation, Customized Financial Needs Analysis

Money Master Pro has experienced associates throughout Canada who can assist you in reaching your financial goals. You can have one of our highly trained and licensed agents meet with you to assist you with creating a personalized financial pathway that meets your families unique needs and goals. Contact us to arrange a free, no-obligation meeting with a Money Master Pro associate in your area. We’ll assist you in getting the insurance coverage you need, investments that work for you in your unique financial situation and so much more.

Why Money Master Pro?

Find out what makes Money Master Pro stand out with our tailored service, licensed advisors, and transparent fees.

Careers

Join a team focused on real client outcomes of growth, training, and meaningful impact.

Contact Us

Have a question? We would be happy to help you. Contact us today!

No Obligation, Customized Financial Needs Analysis

Money Master Pro has experienced associates throughout Canada who can assist you in reaching your financial goals. You can have one of our highly trained and licensed agents meet with you to assist you with creating a personalized financial pathway that meets your families unique needs and goals. Contact us to arrange a free, no-obligation meeting with a Money Master Pro associate in your area. We’ll assist you in getting the insurance coverage you need, investments that work for you in your unique financial situation and so much more.

What Linda Helps You Achieve

Your Path to Financial Success Starts with Money Master Pro.

Lower Taxes

Strengthen Cash Flow

Financial Control

Take full command of your cash flow and spending.

Stronger Savings

Build a safety net that protects you and your family.

Tax Reduction

Keep more of your income with smart, legal and strategic planning.

Tax Smart Retirement Planning

Retire with more freedom and less tax burden.

Consistent Wealth Growth

Grow your savings and investments with confidence and clarity.

Asset Protection

Protect what you have worked hard to build.

Financial Independence

Create a future where your money works for you.

These are not theories. They are practical steps you can take right now.

Build a Substantial, Lasting Legacy

Retirement Guidance

These are not theories. They are practical steps you can take right now.

Who Money Master Pro Is For

01 — Busy Professionals

You want stability but have no time to manage complicated financial strategies.

02 — Families and Parents

You want to protect your household and plan for your children’s future.

03 — Real Estate Investors and Trades Professionals

You want tax clarity, predictable income and strategies that support long-term growth.

04 — Pre-Retirees and Retirees

You want to retire confidently without fear of running out of money.

05 — Immigrant and First-Generation Families

You want clear guidance to navigate the financial system and build generational security.

If you want clarity, confidence and a clear plan, you are in the right place.

As a 30-year-old consultant earning $120,000 annually, I thought I had a solid financial footing—I saved $15,000 in the last few years, but still had a $9,000 car loan weighing me down. That’s when I turned to Experior Financial Group, and I’m so glad I did. Their strategic financial guidance helped me optimize my savings by combining my $15,000 with a small $2,750 loan to contribute to my registered accounts. The result? I received over $9,000 in tax refunds, which I used to pay off my car loan completely. More importantly, Experior helped me build a roadmap toward homeownership. With their continued support and savings strategy, I’m now on track to save approximately $90,000 within two years—enough for the down payment on my first home. Thank you, Experior, for showing me how to use my money wisely and build toward a brighter future.

I’m a new immigrant to Canada, working as an IT consultant, and a proud parent of nine children. A few years ago, I was laid off from my job, and it became incredibly difficult to provide for my family. To keep up with daily expenses, I relied on credit cards and soon found myself with over $55,000 in debt. Even after returning to work, the pressure of trying to pay it all back felt overwhelming. That’s when Experior Financial Group stepped in and helped me create a real solution. Through their debt reduction program, 75% of my debt was eliminated, and I now only pay $200 per month for the next five years. The relief has been life-changing. I finally have room to breathe again — and this time, I’m focused on rebuilding, saving, and creating a stronger emergency fund for my family’s future.

How It Works

1. Book Your Discovery Session

A simple conversation to understand your goals and challenges.

2. Receive Your Personalized Strategy

Linda creates a clear and practical plan tailored to your life.

3. Gain Clarity and Control

You learn how to move forward with confidence and peace of mind.

This is financial transformation through clarity, not complexity.

Your Legacy Starts Now

Your financial decisions create the foundation your family stands on.

The right plan can protect them today and give them strength tomorrow.

Financial stability is not only about money.

It is about security, opportunity and peace of mind.

You deserve a future you can count on.

Your family deserves it too.

EXPERTISE YOU CAN RELY ON

Meet Linda Yao

For decades Linda has helped families, professionals and investors understand and control their finances.

She brings experience from top firms like KPMG and Deloitte.

She also brings more than 30 years of real estate investing and hands-on financial problem solving.

Linda understands what keeps people up at night.

High taxes.

Unpredictable markets.

Cash flow issues.

Retirement fears.

Complex decisions that feel overwhelming.

Her passion is helping you move from stress to clarity.

From confusion to confidence.

From uncertainty to a predictable and secure financial future.

Clients turn to Linda because they want guidance from someone who is smart, warm, honest and proven.

Join the Money Masters Community

A network for high performers committed to building purpose-driven, long-term wealth.

Your Journey to Financial Confidence Starts Today

You deserve clarity, confidence, and control. Money Master Pro™ is here to guide you.

Building Financial Foundations for Families to Empower Them Today and Leave a Legacy for Tomorrow. As with any business, your results may vary. Testimonials and examples are exceptional results and not guarantees. © 2025 Money Master Pro. All rights reserved.